Alternative Payment Arrangements

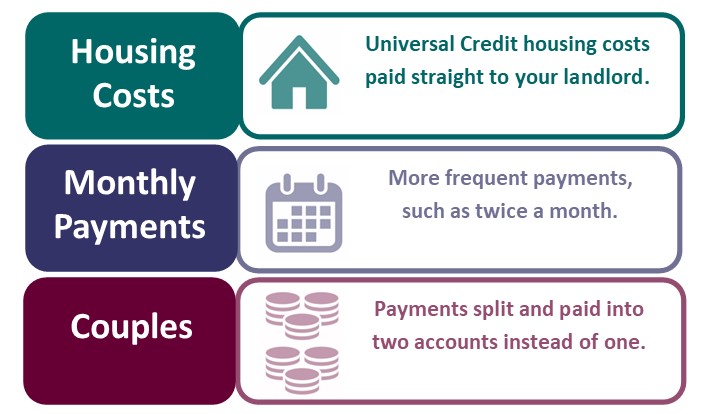

Your Universal Credit is usually paid as a single lump sum, into the account of your choice on a monthly basis.

When you can get an Alternative Payment Arrangement

You might be able to get an Alternative Payment Arrangement if you:

- Are in debt or have rent arrears.

- Have a disability – including a mental health condition.

- Are homeless, have been previously homeless or are at risk of losing your home.

- Have experienced domestic violence.

- Have a learning difficulty, like problems with reading or writing.

- Are in temporary or supported accommodation.

- Are 16 or 17 or leaving care.

- Have an addiction to drugs, alcohol or gambling.

If you’re struggling to get by for other reasons, your application will still be considered – contact a Benefits Adviser for help.

Asking for an Alternative Payment Arrangement

If you’re applying for Universal Credit or you’re about to apply, you should ask for the arrangement you want at your interview.

If you’re already getting Universal Credit, you can make the request on your journal – send your Work Coach a message, or by calling the Universal Credit Helpline.

How long will they last?

Alternative Payment Arrangements are kept under review to make sure they are providing the right support.

When one is agreed you may also be asked to take steps to help you manage your money, such as getting budgeting advice, and you will agree a review date.

The purpose of that review is to decide if an Alternative Payment Arrangement is still the best approach for you.

Example:

Wayne and Carol have four children and have found it difficult to manage their money since the Benefit Cap started to affect them, meaning their benefits were drastically reduced. Wayne had been getting Employment Support Allowance (ESA) because of his health difficulties but has been found fit for work so they claimed Universal Credit. They explained their difficulties to the work coach who then set them up on a Managed Payment to Landlord APA. An amount for their rent is now sent to their landlord (up to the value of their Housing Costs Element).

Example:

Salina, 52, has lost her job and found it difficult to keep up with her rent payments. She thought she’d get another job quickly so didn’t apply for Universal Credit straight away. By the time she applied she was nearly three months behind with her rent. Her landlord applied for a Managed Payment to Landlord APA and now an amount for her rent is sent to their landlord (up to the value of her Housing Costs Element).

Example:

Julie, 19, has difficulties with reading and writing and with numbers. She finds it hard to manage money and is worried about getting her Universal Credit paid all in one payment at the end of the month. Her Work Coach agrees that she can have her UC paid twice a month, which she finds easier to manage.

Example:

Natasha’s partner Charlie is very controlling and won’t let her access any of their money. They are getting into difficulties because he gambles and there isn’t always enough money from his wages or their Universal Credit – which goes into his bank account – to pay the rent. She asks the Work Coach if any of the Universal Credit can be paid to her instead – she agrees to split the payment so that Charlie only gets the single rate Standard Allowance, an amount for their rent is sent to their landlord – all the rest goes into Natasha’s bank account.

Advice on money and debt

You can get help and advice from:

- Your Work Coach

- Citizens Advice

- Money Advice Trust

- The Money Manager tool from Money Advice Service

- National Debtline

- StepChange

- Turn2Us