CORONAVIRUS: Many people have been told to claim Universal Credit because their income has dropped due to the Coronavirus – but this may not be their only option – especially if they are already getting Tax Credits and/or Housing Benefit. See our Coronavirus pages for more information.

When will I have to claim?

New claims for Universal Credit can now be made throughout the UK.

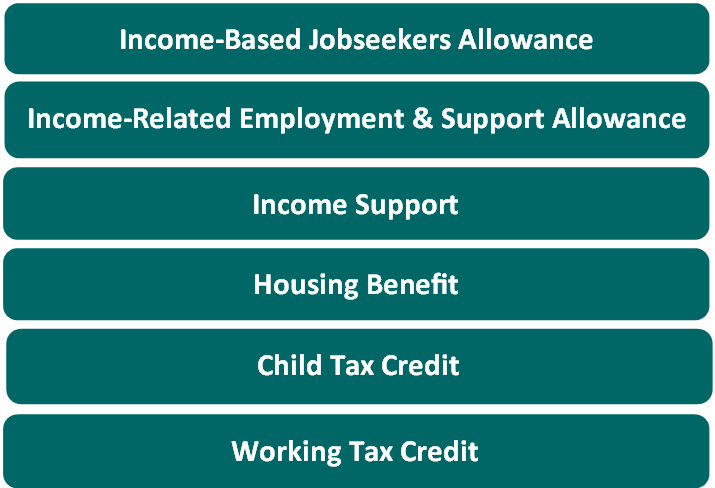

But, you will only need to claim Universal Credit if you have a change in your circumstances that means you would normally need to make a new claim for any of the benefits that Universal Credit is replacing:

- Income-Based Jobseekers Allowance,

- Income-Related Employment and Support Allowance,

- Income Support,

- Tax Credits or

- Housing Benefit.

If you do not have a change in your circumstances then you will not have to claim Universal Credit unless you are invited to do so by the DWP – who will then issue you with a ‘managed migration’ notice. But this may not happen until 2024.

What change might trigger the need to claim?

You may need to claim if you have one of the following changes in your circumstances:

- You are moving to a new Local Authority area and need help with your renthttps://mannligapotek.com/.

- You are finishing work and have no source of income.

- You are separating from your partner.

- You become unfit for work.

Please note this is not an exhaustive list.

But the following changes do NOT normally trigger a new claim for Universal Credit:

- Moving within the Local Authority area – when you are already getting Housing Benefit and you are not having any other change in circumstances.

- Getting some Tax Credits and have a change in your circumstances that would mean more / less Tax Credits such as having a baby, or starting work.

Example:

Glen and Janet live with their two sons in a rented house. They currently get Tax Credits and Child Benefit. Janet has just lost her job. Glen’s job is secure – he works full time. They do not have to claim Universal Credit, they can just report the change to HMRC and have their Tax Credit award re-assessed. But, because Universal Credit would take account of their rental liability, they may be better off on Universal Credit. They should seek advice to see what is their best option.

Example:

Jonathon and Sara are separating. Sara is moving out. They have been claiming Tax Credits to top up her wage. Jonathon gets New-Style Employment and Support Allowance. Because they are separating their Tax Credit award will come to an end. Jonathon will continue to live in their one bedroom flat – but he will need help paying the rent and so makes a claim for Universal Credit.

Example:

Mumtaz has been living in a privately rented bedsit and is moving into a one bedroom rented social rented flat at the weekend. He also gets Income-Based Jobseekers Allowance. As the move is within the Local Authority area he doesn’t have to claim Universal Credit – his Housing Benefit claim can transfer to his new flat and he can stay on Income-Based Jobseekers Allowance.

IMPORTANT: If you are told you have to claim Universal Credit – seek advice immediately from a Benefits Adviser to make sure this is your best / only option, some people can be worse off on Universal Credit.

What if my circumstances don’t change?

If you are already getting one or more of the benefits which are being replaced by Universal Credit (and you continue to be entitled to these) and you do not have a change in your circumstances that triggers a claim for Universal Credit, you may not need to claim Universal Credit until the ‘migration’ stage*, sometime between 2021 and September 2024.

If you are already getting one or more of the benefits Universal Credit is replacing (and you continue to be entitled), then you can continue to receive these.

You will only need to claim Universal Credit if:

- You have a change that stops one of these benefits.

- You have a change that means you now need extra financial help.

- You receive a ‘managed migration’ notice form the DWP*.

* this is where DWP move existing legacy benefit claimants across to Universal Credit under a formal exercise.

Example:

Zoe is a lone parent. She works 16 hours a week and currently receives Tax Credits and a small amount of Housing Benefit. She has two children and enjoys her job. She can’t see that her circumstances will change any time soon.

Zoe does not have to claim Universal Credit. Unless she has a change in her circumstances that trigger a claim (such as a partner moving in) she can stay on her Tax Credits and Housing Benefit until she receives a managed migration notice – which may not be until September 2024.

Can I choose to claim Universal Credit?

If you meet the key claiming rules then you can claim Universal Credit now – but seek advice before you do.

You can choose to move onto Universal Credit at any time – you do not need to wait until a change in your circumstances means you have to.

You should get advice before making the claim to make sure you are not going to be worse off and it is your best option!

You’ll need to think about:

- Whether you (or your partner) would have to look for work as a condition of receiving Universal Credit.

See What do I have to do? for more information. - What deductions might be taken – reducing the amount you’ll receive.

See Deductions for more information. - Will you be okay paying your rent yourself (if you have Housing Benefit paid directly to your landlord)?

See Help with your rent for more information. - Do you have an email address, and mobile phone number?

- Will you need to open a bank account?

See Do I have to have a bank account? for more information. - Do you have regular access to the internet?

- Will you manage budgeting your money monthly?

See Getting paid for more information. - If you work then consider how Universal Credit will work for you, especially if you need help with your childcare costs – as you will need to pay for these upfront.

See How does UC work for workers? for more information.

Example:

Samia lives with her two grown up sons in a rented three bedroom house. She currently receives Carers Allowance and Income Support – she cares for her elderly dad who lives on the same estate. She isn’t entitled to any Housing Benefit because both her sons work and when the HB Office work out her entitlement they take off two non-dependant deductions. Her Income Officer explains that she could be better off on Universal Credit and suggests she contact a Benefits Adviser to check this out. The Benefits Adviser explains that because she is a carer she would not have any work search on UC. Also, because of lower non-dependant deductions she would be entitled to more Universal Credit. The adviser discusses budgeting and potential deductions that might be taken off her Universal Credit award. Samia decides to make a claim and she finds that she is over £450 a month better off.

Frequently Asked Questions